Inclusive housing finance: Unlocking stability in the face of climate emergencies

Climate change poses a significant threat to housing security, particularly for low-income communities. Extreme weather events, such as hurricanes, floods and wildfires, are becoming more frequent and severe. Furthermore, sea level rise poses an increasing threat to families and their homes in low-lying coastal regions. Residents in low-income countries are 15 times more likely to die from floods, droughts, storms and other extreme weather events than residents in wealthier areas.

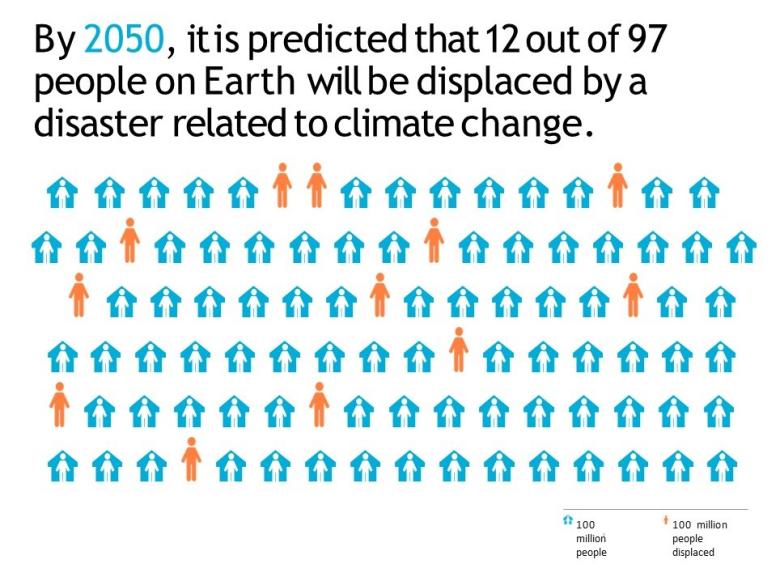

Disasters brought on by climate change are predicted to displace 1.2 billion people globally by 2050, which will drive spikes in migration and urbanization, putting further strain on housing resources.

Despite promising growth in account ownership in recent years, 1.4 billion people remain unbanked, and 80% of them reside in climate-vulnerable economies. Financial inclusion has a critical role to

play in continuing to drive this number down while disrupting the cycles of poverty and displacement exacerbated by climate change.

Providing accessible microloans and mortgage options with reasonable interest rates, along with insurance and savings solutions, will enable families to invest in a safe and stable home.

Emerging data and technology-driven business solutions are also gaining force as a means to efficiently deliver services at scale in both rural and urban areas. Coupled with innovative building materials and housing techniques, these new solutions offer an opportunity to affordably address the resilience and energy efficiency of the global housing stock.

Innovative building materials and housing techniques will not only improve the housing and economic security of vulnerable families but will also help reduce the built environment’s substantial contribution to global greenhouse gas emissions.

Real-world successes are demonstrating that carbon-neutral solutions can thrive beyond the borders of the world’s richest economies. This year, India surpassed both the United States and China to claim the top place on global rankings for LEED Zero certifications, with 45% of the world’s LEED Zero buildings.

Financial services providers, working in tandem with housing organizations, can create tailor-made financial products that offer affordable interest rates and flexible repayment plans, ensuring that no family is left behind.

Working in collaboration with Habitat for Humanity and local financial services providers, SCBF found success with this approach in Cambodia by developing accessible microloans and micromortgage products that empower low-income families to construct or upgrade their homes for greater resilience. Recognizing the importance of housing finance linked to climate and migration, SCBF has also included a housing finance vertical in its 2030 strategy to address the challenges the pioneer gap enterprises face while scaling up to provide much-needed sustainable solutions to low-income populations.

Sitara Merchant - Chief Executive Officer Swiss Capacity Building Facility (SCBF)

The need for climate-resilient housing among low-income families is not just a pressing issue; it’s an urgent call for action. The devastating impact of climate change on vulnerable communities demands a comprehensive response that addresses housing insecurity and financial exclusion simultaneously. Together, we can turn the tide and empower low-income families to thrive in the face of climate change, ensuring that every person has a place they can call home — a place of safety, stability and hope. The time to act is now; the future of our planet and its people depend on it.