What is housing affordability?

Families across the United States are paying too high a price to cover the cost of home. Rents and homeownership costs are skyrocketing while wages are not keeping pace.

Today, 20.3 million U.S. households pay over half of their income on a place to live. That means nearly 1 in 6 families are denied the stability that safe, decent and affordable housing provides.

At the most basic level, what makes a home affordable comes down to simple math. Subtract your monthly rent or mortgage from your take-home pay, and you should have enough money left over for life’s necessities.

Too many people are having to make tough choices, the result of two major trends — lagging incomes for low- and moderate-income families, and the soaring cost of housing, says Chris Herbert, managing director of Harvard University’s Joint Center for Housing Studies. “You look at this and say, ‘Is it a housing problem, or is it an income problem?’ I would say it is both.”

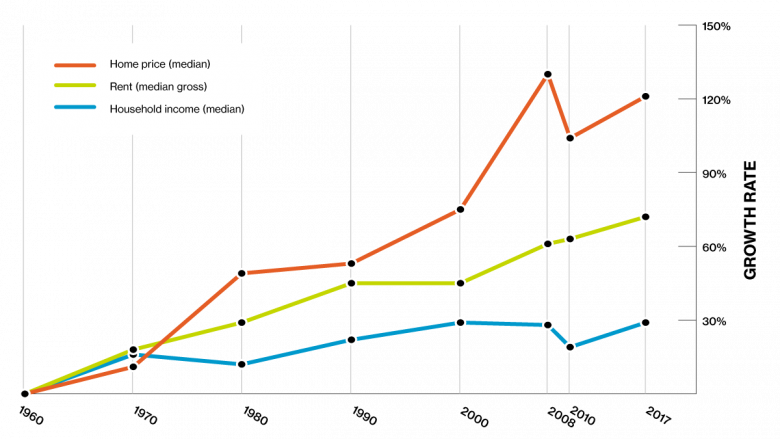

Today’s real average wage — after accounting for inflation — has about the same purchasing power it did 40 years ago, according to Pew Research Center. Meanwhile, the Joint Center for Housing Studies notes that both the median home price and median rent has risen faster than overall inflation over the past 25 years — 41% and 20% respectively.

Growth rates in home prices and rent vs. household income in the U.S. since 1960

Source: 1960-2000 Decennial Censuses and 2008, 2010 and 2017 American Community Surveys

Experts generally say that the maximum a family should pay for housing is 30% of their income. Any more than 30%, and a family is considered cost-burdened, which means they often find themselves making tough choices when it comes to other needs.

Ebony understands those impossible choices. The U.S. Army veteran and mother of three used to be riddled with anxiety because her rent commanded almost all of her monthly income.

Because Ebony had nothing left over for the utilities, car payment, health insurance and child care, she was forced to engage in a game of bill shuffling. “I would pay some bills one month, others the next,” she says. “I had to get creative with meals and went to three or four food banks.”

After partnering with Habitat, her mortgage is 30% of her income. She can now pay her other bills on time and even has been able to put some money away. “Having a house that I can afford allows the chance of living the kind of life I always wanted for my kids. I feel like everyone should have the chance to feel the way that I feel.”

More families should know that feeling.

“Families should not have to live in fear of choosing between paying for a roof over their head or paying for food or medicine or clothing for their kids.”— David M. Dworkin

“The scale of this problem is far too large for any one organization to address on its own,” says Adrienne Goolsby, Habitat for Humanity International’s vice president for U.S. and Canada. “We are ready to join with other stakeholders at the local, state and national level to address the unrelenting crisis in housing affordability.”

“Families should not have to live in fear of choosing between paying for a roof over their head or paying for food or medicine or clothing for their kids,” says David M. Dworkin, president and CEO of the National Housing Conference, a Washington, D.C.-based nonprofit that advocates for people of all income levels to live in safe, decent affordable homes. “Affordable housing allows families and individuals to have the opportunity to be empowered to choose where they live. Where our children go to school and how much of our day is spent commuting are choices that should not be dictated by our economic circumstances.”

We agree wholeheartedly. When the cost of home is your family’s future, the cost is too high. When the cost of home is any family’s future, that’s something none of us can afford.

Through our Cost of Home campaign, we mobilized local organizations, partners, volunteers and community members across the country to find solutions and to help create policies that allowed 9.5+ million individuals to have access to affordable homes.

Together, we can make the cost of home something we all can afford. Join us!