Equitably increasing access to credit

Credit is critical to buy a home, and homeownership is the primary source of wealth for most Americans. Yet, it’s difficult for many households to access, and minority and lower-income applicants often do not have access to credit at all or have access only to predatory credit.

That’s why the Cost of Home campaign made equitably increasing access to credit one of its key areas of focus.

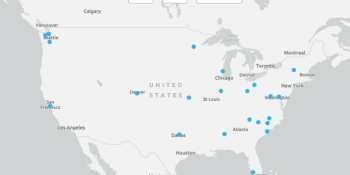

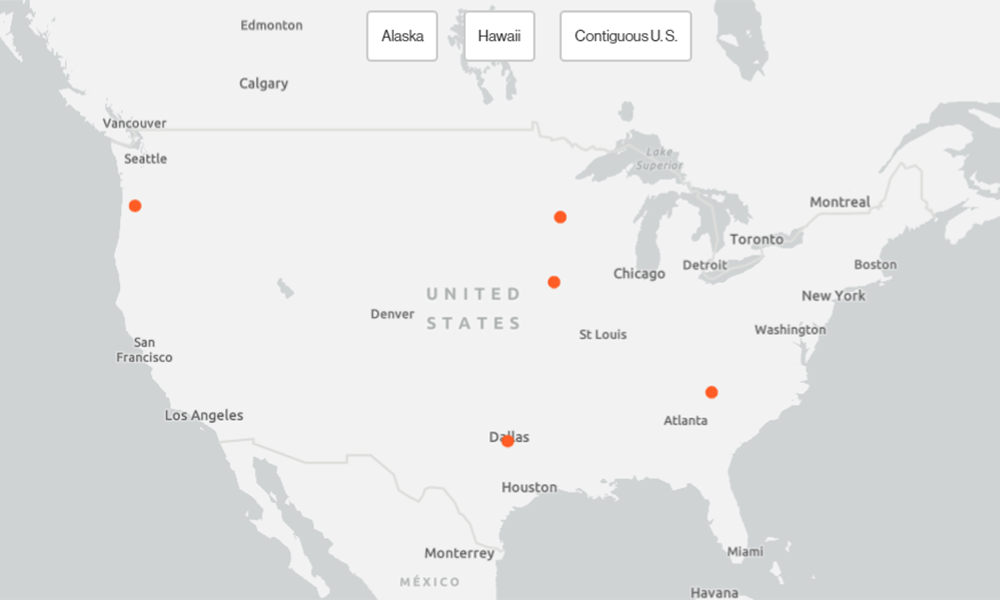

Check out our interactive map to see areas where local and state Habitat organizations have successfully changed housing policies to equitably increase access to credit.

Excluding low-wealth and families of color to access the credit for homeownership deepens existing racial, wealth, health and educational inequities.

To combat these inequities, local and state Habitat organizations have successfully advocated for policies that increase and broaden access to credit for underserved populations, including policies that address the homeownership gap for communities of color.

Strategies used to equitably increase access to credit for underserved populations:

- Expansion of down payment assistance.

- Adoption of tax policies that increase access to affordable homeownership for lower-income households.

- Investments in homebuyer counseling and financial education.

- Restrictions on predatory lending.

- Increase in options for families in debt.

- Income boosts for working families through state earned income tax credits.

- Additional support for individual development accounts.

“By leveraging their equity, families can do repairs on their home, pay for a college education. They can invest.”

What inequitable access to credit means

Generally, institutions that extend credit aim to serve wealthier populations because their business model largely depends on it, says Jesse Van Tol, president and CEO of National Community Reinvestment Coalition, an organization that champions fairness in banking, housing and business development.

“You can see a huge social injustice when you look at how, historically, access to ownership and down payments often come from intergenerational wealth — from parents’ or grandparents’ mortgage assets.”

“It’s important that all folks have the opportunity to move into the wealth-building opportunity of homeownership, thereby freeing up a spot a little lower down on the affordability spectrum on the rental side,” says Vilhauer. “We’re all part of the same continuum of housing stability, so making opportunities for stable housing at each level positively impacts us all.”

Our impact

Check out our solutions in action:

- Policy successes mapped by policy focus area and geographies.

- A typology or searchable database of policy changes achieved by Cost of Home.

- Urban Institute brief on searchable database.

- Strategies for advocates to influence home affordability policies.

- Urban Institute policy assessment report.

Join us

Though the Cost of Home campaign has concluded, the work continues. Learn how you can add your voice to support equitable access to credit for all.