A closer look at home affordability in the U.S.

In the U.S., soaring housing prices and a record-low supply have made the dream of homeownership unattainable for millions. This is especially true for low-income households and households of color.

“When the data shows us that almost 43 million U.S. households are cost-burdened by high housing costs, it’s not just a number — it’s a crisis. In my home state of North Carolina, the housing shortage has surged by nearly 270% since 2014,” says Jonathan Reckford, CEO of Habitat for Humanity International. “One thing is clear: The need for Habitat and our approach to affordability has never been more urgent.”

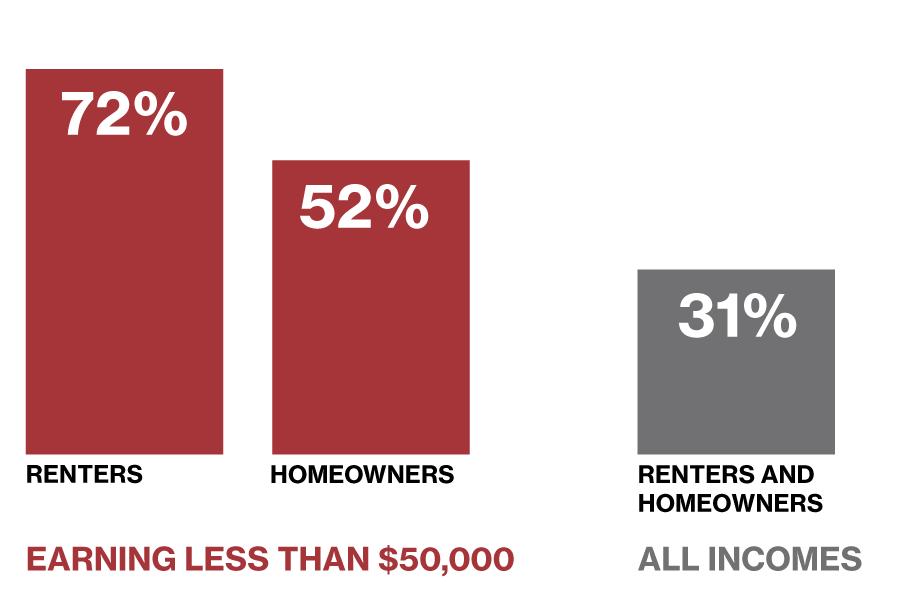

Share of households paying over 30% of their income on housing 1

70%

INCREASE IN HOUSING SHORTAGE SINCE 2014

The scale of the growing housing crisis mandates that we do all we can. We build and repair, we create access to affordable financing, we partner with residents to revitalize their communities, and we advocate for policies and systems that make lasting, affordable homeownership accessible to everyone.

Our advocacy centers on increasing the supply of affordable homes, ensuring equitable access to homeownership and improving homeownership resilience.

Our network actively advocates for new and improved policies that have a direct impact on home affordability.

Here’s what just a few of our successes look like:

MidOhio Habitat successfully advocated for the first-ever bond dedicated to building affordable homes in the city of Columbus.

Habitat Florida and participating affiliates advocated for a statewide act that increases home affordability so that Florida workers can live closer to the communities they serve.

Habitat Clallam County in Washington state secured zoning changes to allow multifamily housing in more areas, increasing housing availability.

Each policy win makes the vision at the very heart of our work that much more accessible.

There is so much more to be done. Find out how you can advocate, helping in your community and across the U.S.

References

1. IPUMS (2022 American Community Survey 1-Year Estimates).

2. Assumes a 10% down payment, 28% payment-to-income ratio, 5.3% interest (median in 2022), nationally typical mortgage insurance and homeowner insurance, and state-specific taxes (Sources: Freddie Mac, National Association of Home Builders Priced-Out Estimates for 2022, Census Bureau’s 2022 and 2021 ACS 1-Year estimates, Zillow Home Value Index).

3. IPUMS (2022 ACS 1-Year Estimates).